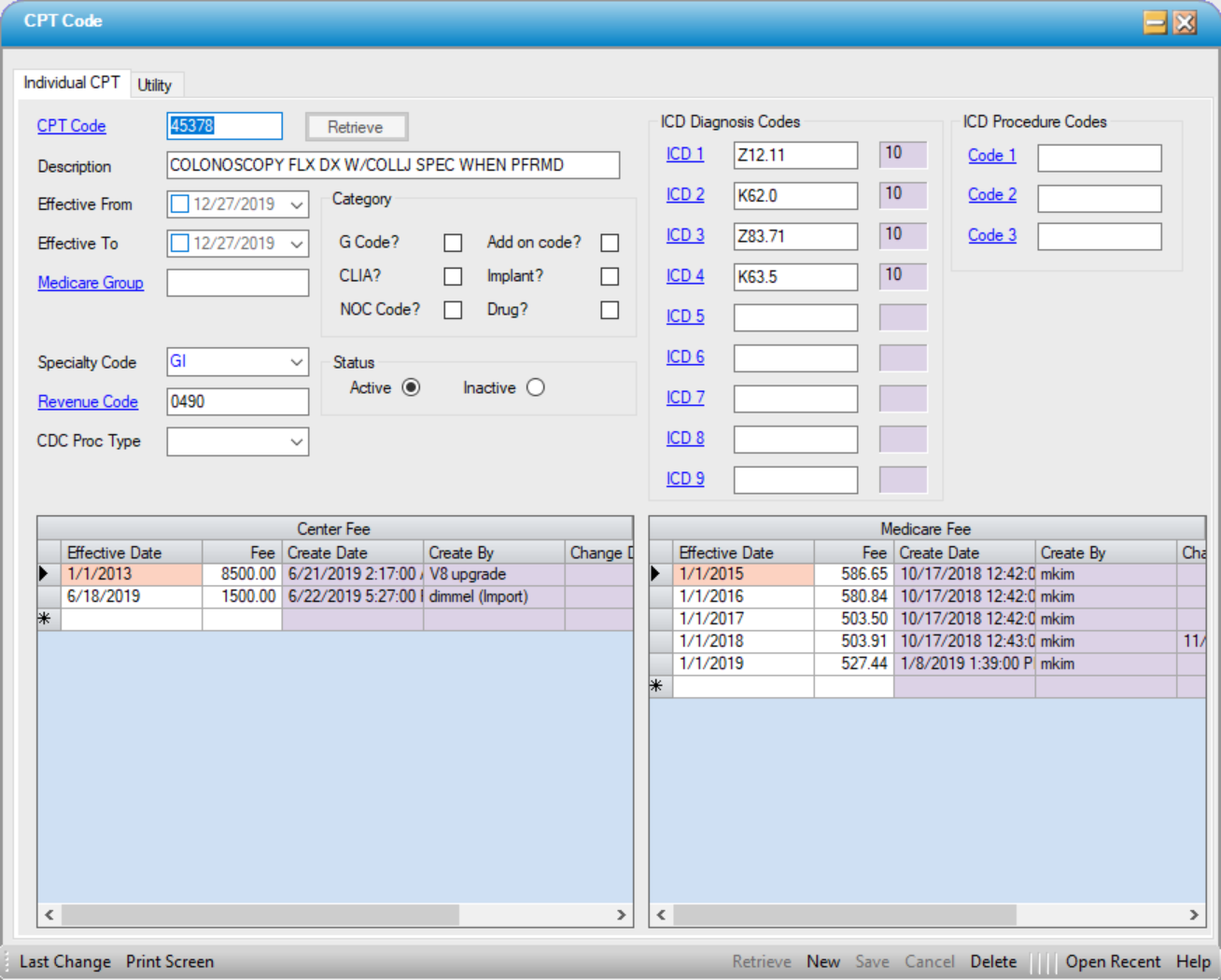

CPT Code

Administration > CPT Code

Use this form to define and maintain CPT Codes.

Individual CPT

- To Edit a CPT code, enter the CPT Code and select the

function or select the CPT Code hyperlink to search by Description or CPT.

function or select the CPT Code hyperlink to search by Description or CPT. - To enter a new CPT Code, select

or New and enter CPT Code.

or New and enter CPT Code.

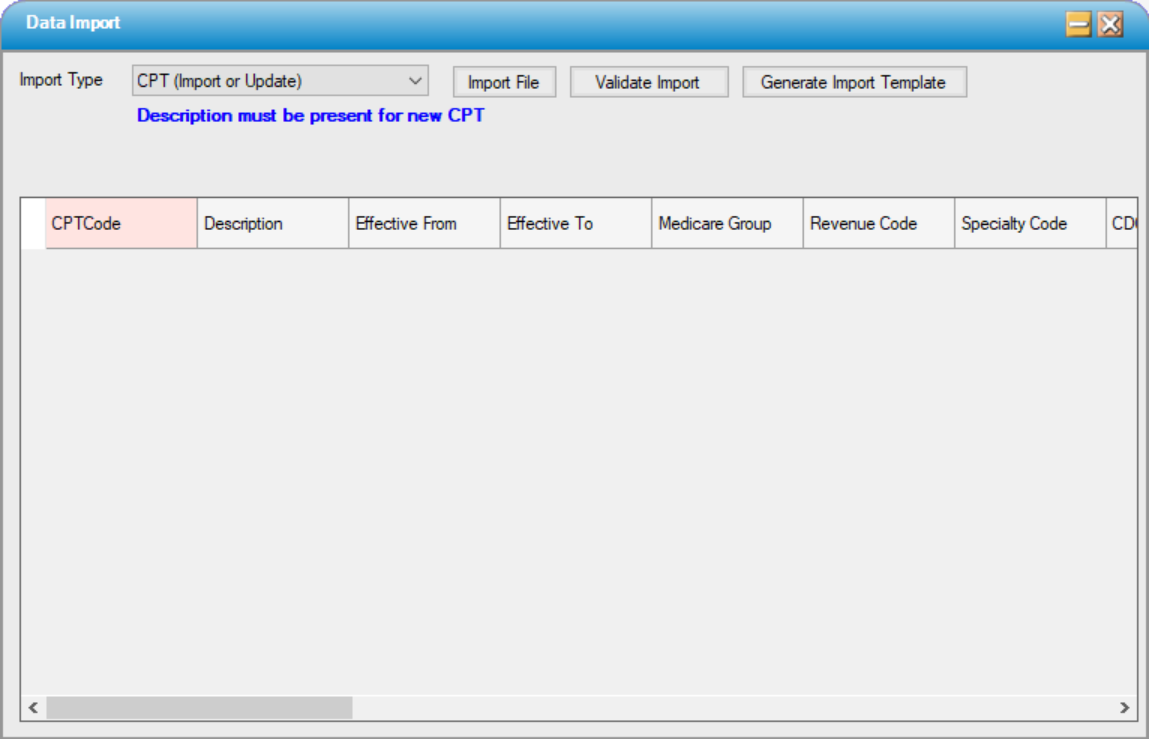

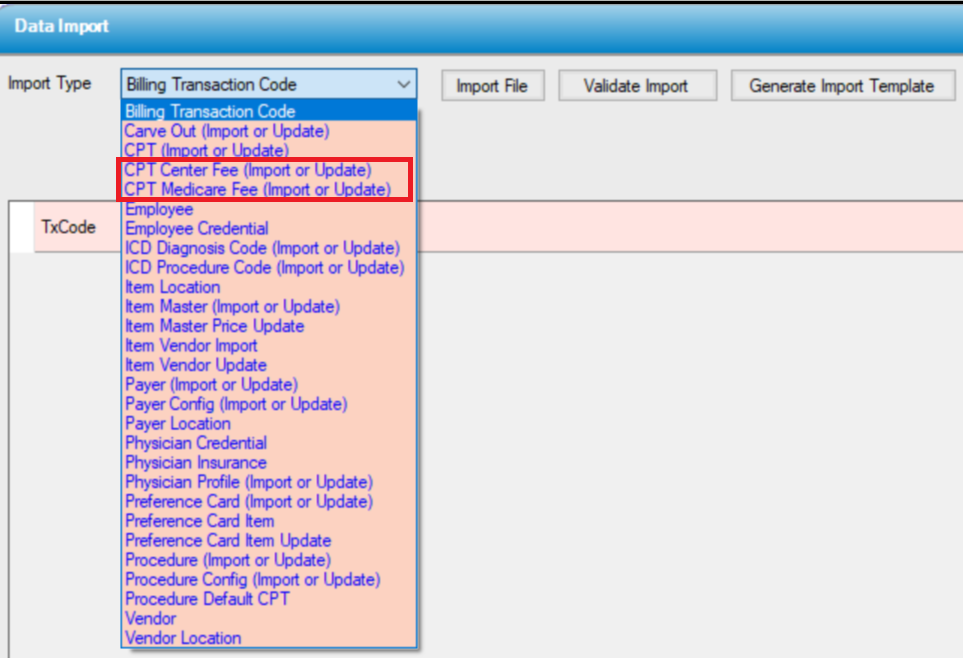

CPT Codes can also be entered and updated utilizing the Utility > Data Import > CPT (Import or Update) function.

- Enter the current Description for the CPT Code entered or selected.

- Entering Effective From and Effective To dates will allow the entry of new codes prior to release. Example: CMS OPPS is released prior to end of year with new codes that will be effective January 1. The codes can be entered upon release with an Effective From date of 01/01/xxxx. The system will not allow these codes to be loaded in charge entry until on or after the Effective From date. Likewise, If CMS reports that certain codes are being inactivated, an Effective To date can be entered, which will prevent the use of these codes in Charge Entry once this date has passed.

- If a center has contracts that pay based upon Medicare groupers, enter the Medicare Grouper for each code so they are profiled correctly when running Patient Estimates or entering charges for these payers.

- Specialty Code is an Enterprise Code Table maintained by the organization or center. Once this table has been built, selections can be manually entered or selected from the drop down.

- Enter the Revenue Code that corresponds to the CPT Code entered or select the Revenue Code hyperlink to search by Description or Revenue Code.

- CDC Procedure Type is also an Enterprise Code Table maintained by the organization or center. Once this table has been built, selections can be manually entered or selected from the drop down.

Category

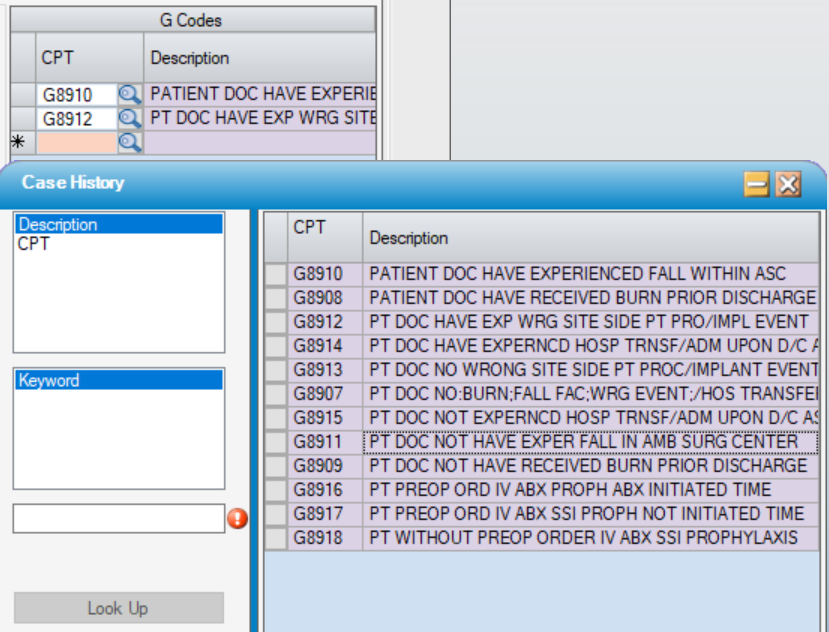

- G Code? - Selecting the check box for G Code? will make these codes available for selection on the Operative Records tab in Case > Case History

- Clia? - Selecting the CLIA check box will designate codes as those used for laboratory testing for compliance with CMS billing requirements. CLIA is the United States federal regulatory standards that apply to all clinical laboratory testing performed on humans in the United States.

- NOC Code? - Selecting this check box will designate that this is an NOC (Not Otherwise Classified) code. NOC codes are used if there is no accurate CPT code to choose for reporting purposes. Checking this box will ensure that any description that is manually entered at Charge Entry will print and/or transmit on claims for this code.

- Example: CPT 48199 = Under Other Procedures on the Dentoalveolar Structures. If this description is what is entered in the CPT Code configuration, this is what will appear in Charge Entry when billing by CPT Code. This can be changed, however, to reflect the actual procedure performed: such as an extraction, root canal, endodontics, etc. as well as adding the specific teeth. If this box is checked, the edited description will appear on the claims.

-

Add on code? - Checking the Add on code? box will classify the code as an Add On Code, which will determine where it falls in the Optimization sequence. Since Add On Codes can not be the primary billing code, codes with this category will always fall below non-categorized codes, even if the contractual reimbursement for the Add On Code is higher.

- Implant? - Checking the Implant? box will categorize the CPT Code as an implant. This will create an alert if/when the code is added to an Item in the Item Master, will open the description and cost to editing in the Patient Estimator, Supply Used, and Implant Log and will also determine where the code falls in the Optimization sequence.

- Drug? - Checking the Drug? check box will have the same results described under Implant?

Status

- Status will default to Active. To inactivate a code, select the Inactive radio dial.

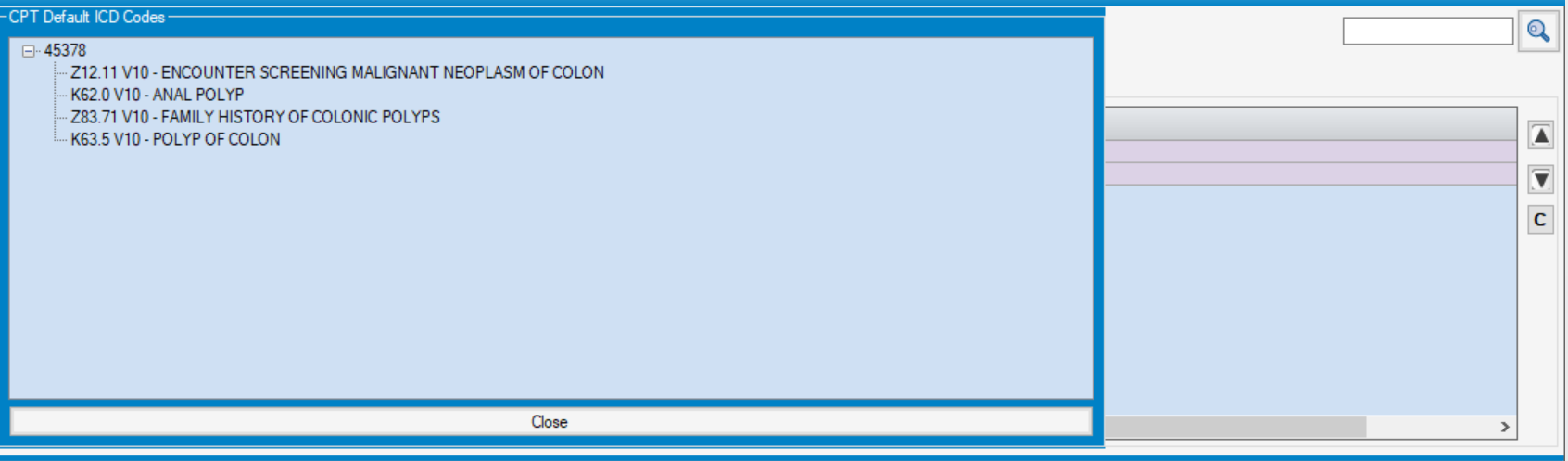

ICD Diagnosis Codes

- The nine most commonly used Diagnosis Codes can be mapped to a CPT Code for selection in Charge Entry. Codes entered here will be available for selection when the

for Common ICD Diagnosis Codes is selected in the Charge Entry form.

for Common ICD Diagnosis Codes is selected in the Charge Entry form.

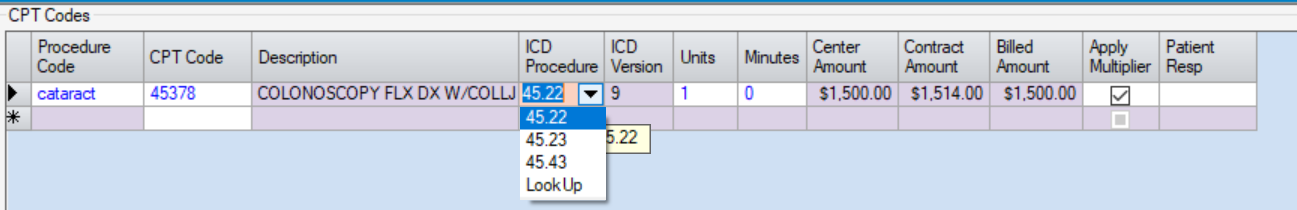

ICD Procedure Codes

- If centers have insurance contracts that still require ICD Procedure Codes, the three most common ICD Procedure Codes can also be mapped to the CPT Code. The first code entered will default in Charge Entry. The additional codes will be available from the drop down. (If a code is required that was not entered here, select LookUp to find the correct code.)

Center Fee

- The effective Center Fee amount is also date of service driven. When a new fee line is added, the previous line naturally expires. The Center Fee will populate the correct rate in Charge Entry based upon the date of service compared to the Center Fee effective date. This allows centers to make updates to their Center Fees prior to the new year.

- To enter a new Center Fee, manually enter the Effective Date or select from the drop down calendar. Enter the new Center Fee.

NOTE: A Center Fee is required to load a CPT Code in Charge Entry, so for codes on which the price may vary (such as drugs, implants, and extraordinary supplies), enter a Center Fee of $0.00.

Medicare Fee

- The Medicare fee schedule is a complete comprehensive listing of the fee maximums used by Medicare to pay contracted providers and suppliers for their services and products. Medicare will publish fee changes once or twice per year. When a new Medicare Fee is added the previous line naturally expires. The current Medicare Fee is the fee that will be utilized for reimbursement calculations for Medicare and payers that contract at a percent of the current Medicare rate.

NOTE: Both the Center Fee and the Medicare Fee can be entered and/or updated utilizing the Utility > Data Import function.

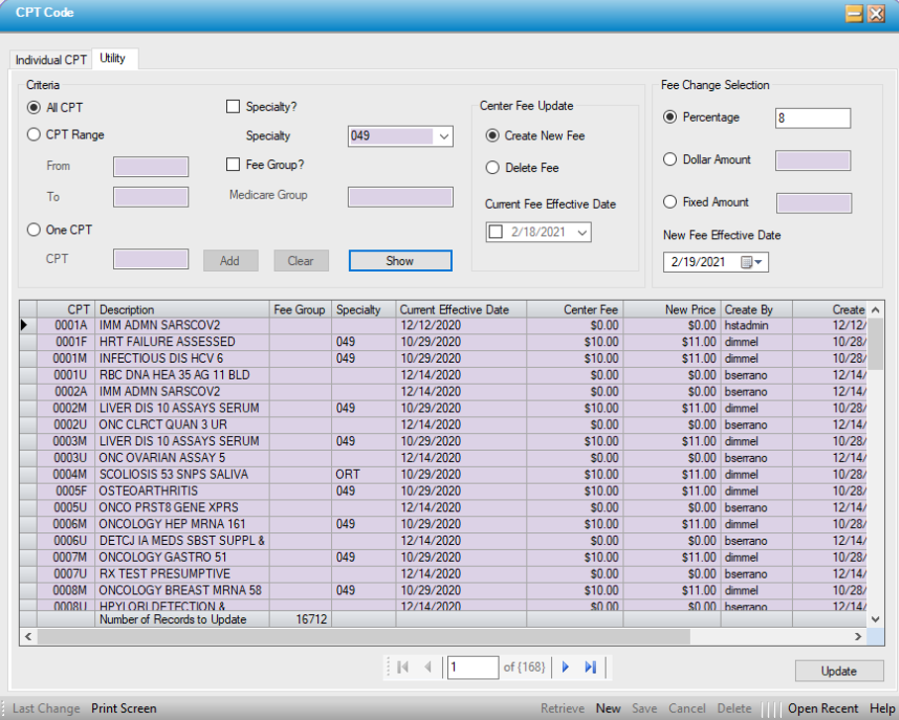

Utility

Practice Management provides the ability to make individual or comprehensive changes to CPT Code fees through the Utility tab.

Criteria

- Centers may select the radio dial for ALL CPT, CPT Range, or One CPT. If All CPT or CPT Range are selected, results can be further streamlined by selecting Specialty, Fee Group, or Medicare Group.

- To enter individual CPTs, click on the One CPT radio dial, enter the CPT Code, then click

. Additional codes can be entered.

. Additional codes can be entered.

Center Fee Update

- Select Create New Fee radio dial to update fees. Enter current effective date. (If fees are updated the 1st of each year, enter January 1 of the current or previous year.)

- Select Delete Fee to delete the current fee. Enter the Current Fee Effective date. (This optional and can be utilized if an error was made in updating the fees to delete that update and start over.)

Fee Change Selection

- Enter the percentage, dollar amount, or fixed amount that will apply. The system will allow positive or negative figures (i.e., If “-5” is entered in the percentage field, the system will reduce the CPT fees by five percent).

- To change fees to a fixed price, use the Fixed Amount field to designate that fee. (This option may be most commonly used for drug or implant codes, with a Fixed Amount of $0.00.)

- Enter the New Fee Effective Date (the date the new fees will go into effect).

- Once all selections have been entered, click

. All selections will be displayed, including the existing Center Fee and the new price specified above.

. All selections will be displayed, including the existing Center Fee and the new price specified above. - Click

to save the changes and update the CPT Fees.

to save the changes and update the CPT Fees.

NOTE: As previously indicated, the Utility > Data Import function can also be used to update Center Fees.